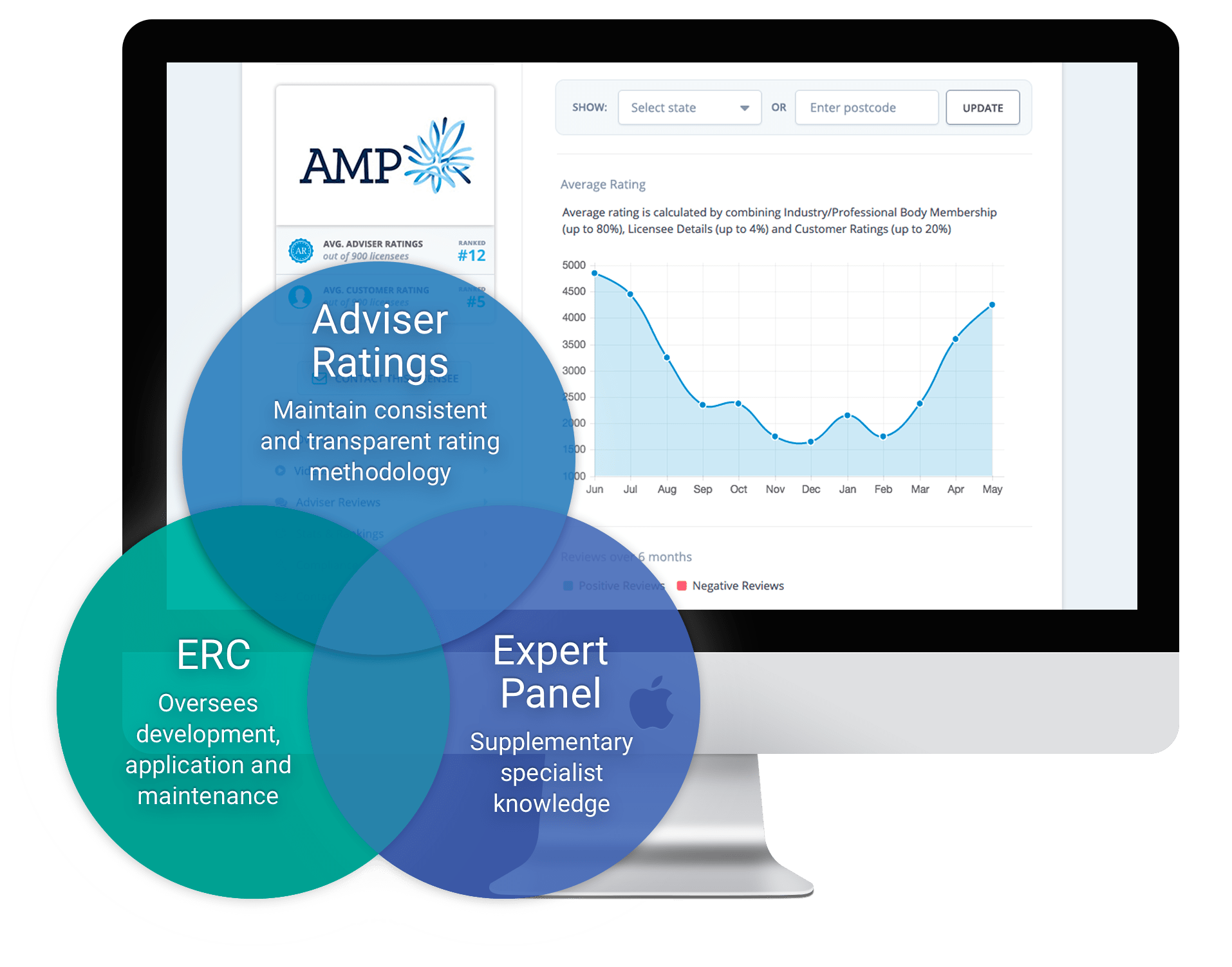

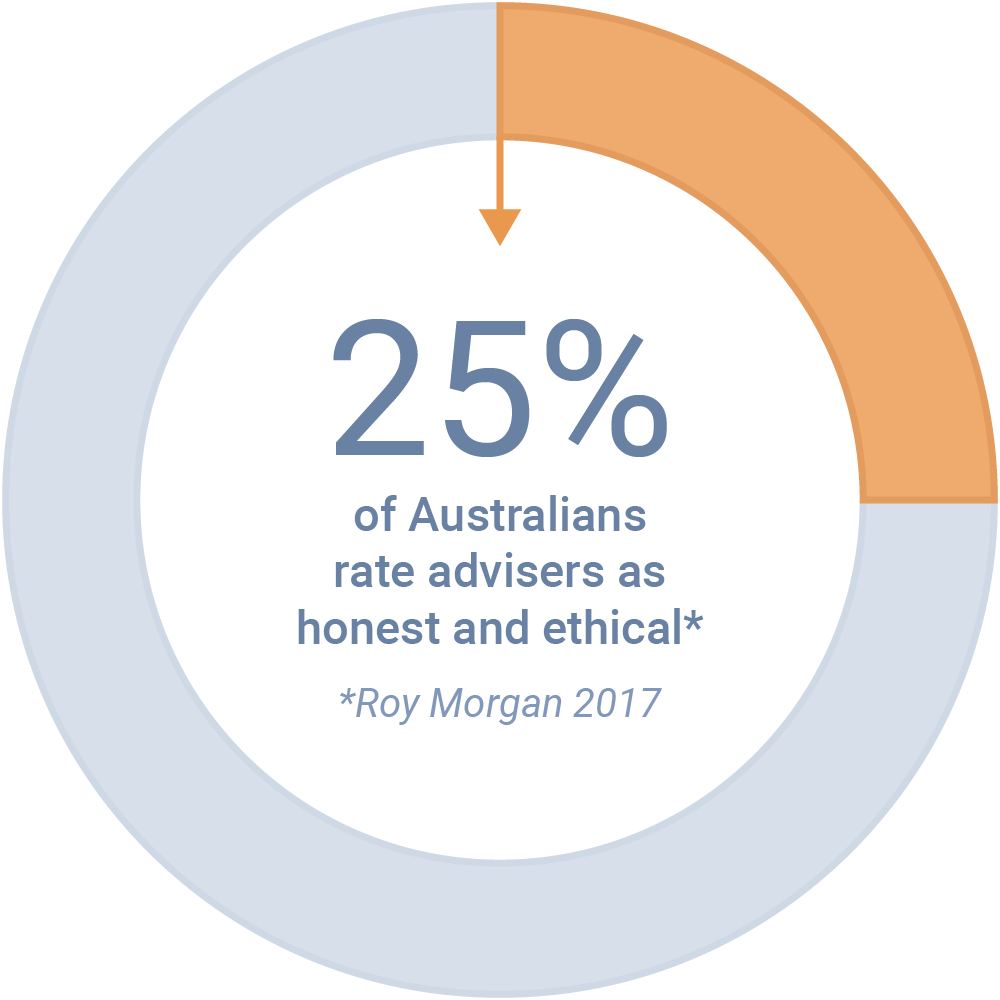

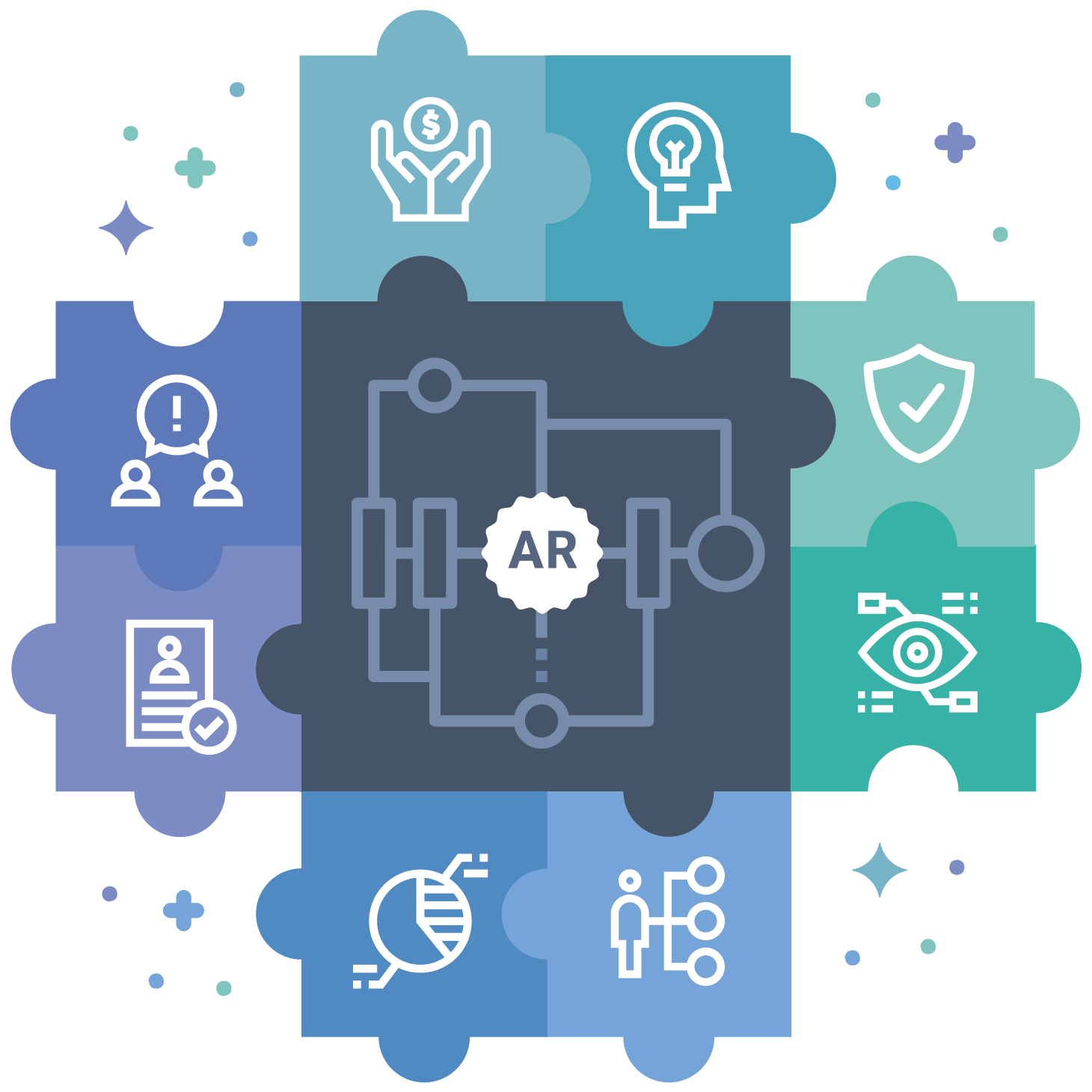

The licensee “quality-of-advice” rating system is an industry-led initiative to be launched by Adviser Ratings. The ratings will evaluate a financial advice licensee’s ability to support their authorised representatives to deliver quality professional advice in the best interest of their clients. This will include how licensees respond to future legislative requirements arising from recommendations submitted by the Royal Commission.

Apart from internal benchmarking purposes, the ratings and supporting research will be relied upon by numerous stakeholders including government, regulators, financiers, insurers, industry vendors, other licensees, internal and external financial advisers, and consumers.