Compliance Products

A systematic way to control new compliance risk

A systematic way to control new compliance risk

The Design and Distribution Obligations Act (DDO) received Royal Assent on 5 April 2019 and is already in force. Acting as additional consumer protection, this new level of compliance requires product issuers to take reasonable steps to ensure their product is limited in distribution to the determined target market. Accompanying intervention powers provide ASIC with a path to recommend civil penalty proceedings or criminal prosecution if the Act is not followed.

As such product issuers need to start thinking about how they will satisfy their DDO obligations and build this into their compliance systems and processes. This extends to ensuring third party risk is managed by advisers and other distributers by carrying through these obligations.

Far reaching consequences such as these require an industry-wide approach.

As an industry leader in compliance and data, we’re providing guidance to product issuers to ensure these requirements are applied consistently across the market. As first to market in providing a framework to satisfy these requirements, our goal is reduce confusion for the network of interrelationships among financial services entities.

Introducing a framework to satisfy new complience requirements and avoid compliance consequences. With the most comprehensive and accurate data set in financial services, we are able to provide first steps for product issuers to avoid falling afoul of these compliance requirements.

By accessing and using AR data’s compliance products, financial issuers can prove to ASIC they’ve taken reasonable steps to ensure their product has been appropriately distributed. Our service is one of a kind, and allows financial issuers the ability to track the appropriateness of the advice through to the adviser.

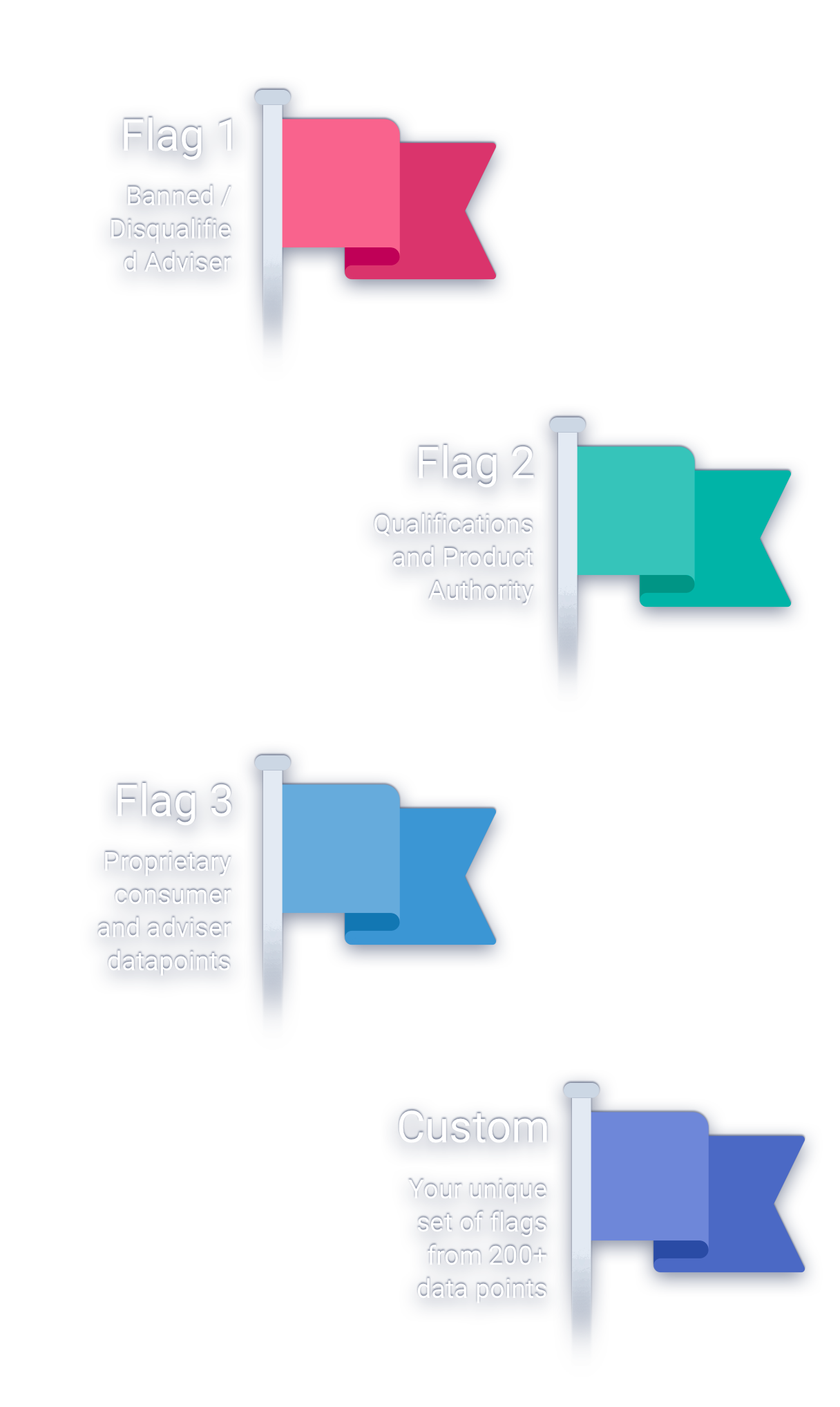

We provide an effective three flag system to ensure reasonable steps have been taken by product issuers to work within the new Act. We call this Knowing Your Adviser:

Flag 1 – Banned / Disqualified Adviser

Flag 2 – Qualifications and Product Authority

Flag 3 – Proprietary consumer and adviser datapoints

Custom flags

Does your company have a specific important data point? We have up to 200 separate data points and can help to develop a unique set of flags.

Future additional compliance levels

An additional layer of compliance is coming in the form of our upcoming licensee ratings system with the former deputy chair of ASIC Peter Kell

An example of an early adopter avoiding compliance consequences

Beginning problem – A major superannuation fund with a nascent financial advice strategy was attempting to grow out their financial advice service offering. Launching any new large scale service comes with a level of internal process growing pains. Small differences in data input was just the beginning, as there was no methodology to tell which advisers were appropriate to work with.

As the super fund began offering adviser solutions for their clients, they wanted to ensure only the most appropriate advisers were recommended. However as this was a new field, internal staff were unfamiliar with recording this type of information. Wanting to improve this business control, the super fund worked with AR data to build a system that would firstly identify which adviser the company was speaking with, and secondly to determine if they were the best fit for their clientele.

Once the AR data had been absorbed by the super fund and incorporated into their systems and processes, identification of each adviser improved ten fold. With this increase in adviser insights, the super fund was able to make better and informed decisions on which advisers they wanted to work with. As the new adviser service continues to roll out, the super fund is now far better positioned to deliver value to their members, and importantly has now a process to prove to ASIC reasonable steps have been made to ensure the client/adviser relationship is appropriate.